If you’re injured and need to file a claim for disability, the pay stub verifies the income you earned before you became disabled. The pay stub supports the loan application. Pay stub information helps a landlord confirm your ability to make rent payments.Ĭontractors and self-employed workers may need business loans, such as a line of credit. If you’re leasing a vehicle, the car dealer will want proof of your income. The income reported on the pay stub supports your ability to repay a loan. Here are some situations that require the information from a pay stub: Who Needs to Prove Income Using a Pay Stub?Įmployees, contractors, and independent contractors need pay stubs as proof of income and stable employment. Tradespeople: Plumbers, carpenters, tree service firms, landscapers.Corporations: Both small and large corporations of all types.Institutions will still require pay stubs. Personal transactions, so that you can report the correct amount of businessĮven if you are self-employed, many banks and You need to separate your business expenses from If you’re the owner of a single-member LLC, forĮxample, it’s important to keep track of all payments made from the LLC to your Self-employedĪs a self-employed person, you will still find pay If the amounts don’t agree, contract the client to resolve the problem. If Acme Manufacturing pays you $5,000 for contracting work in 2020, that dollar amount should be listed on the 1099, and on the year-end pay stub. Workers receive 1099s at the end of the year, which verify income received fromĪ pay stub can help the contractor verify that the dollar amount on the 1099 is correct. It’s useful for someone who is filing his or her tax returns.ĭefinition, are not employees and do not have taxes withheld from pay. Stubs show an employee’s income, taxes paid, and other contributions. The details about the employer and the worker’s salary prove employment and total income.When you’re applying for a loan or renting a home or apartment.

Some entities require pay stubs as proof of income Institutions require pay stubs as proof of income, even if employers are not The total dollar amount ofĪll pay stubs should be compared to the wage expenses and other labor costs inįor employees, the most important function of pay

States require firms to file and issue pay stubs. Who Needs Pay Stubs? EmployersĮmployers need to generate pay stubs, because some Once you have a completed W-4, you’ll need to collect additional information for the pay stub. To create a pay stub, the first step is to have each employee complete a Form W-4.

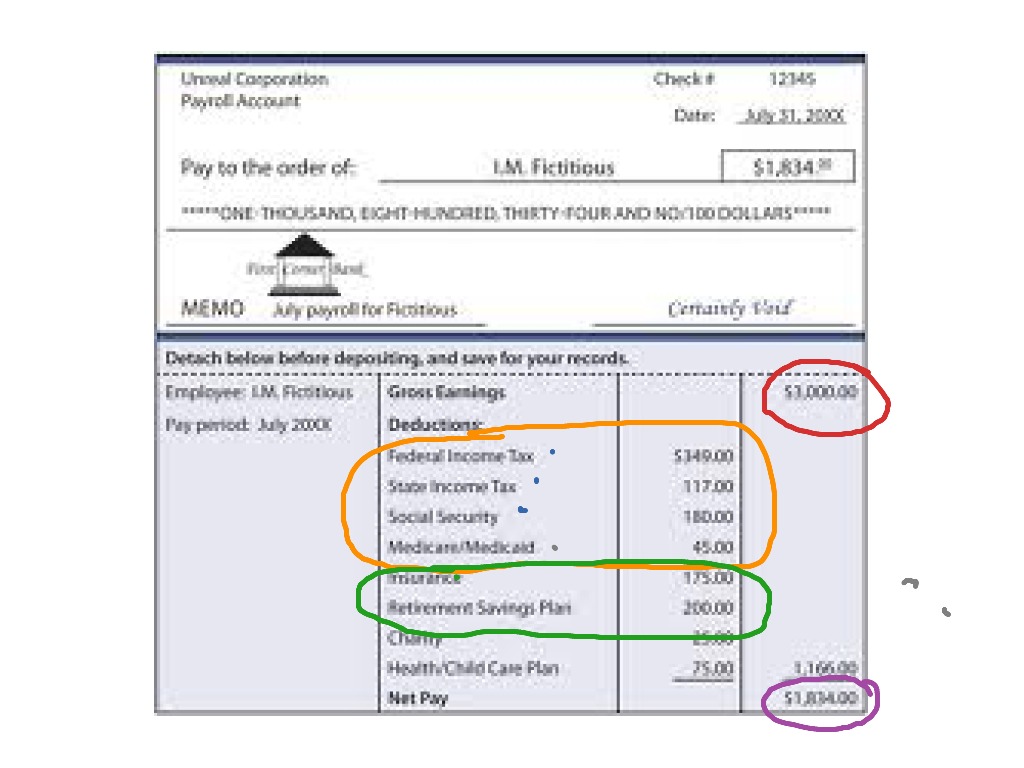

The pay stub information should match the data on each employee’s W-2 form, which individuals use to file their personal tax returns. Such as the worker’s share of insurance premiums The employee was paid (before any deductions)

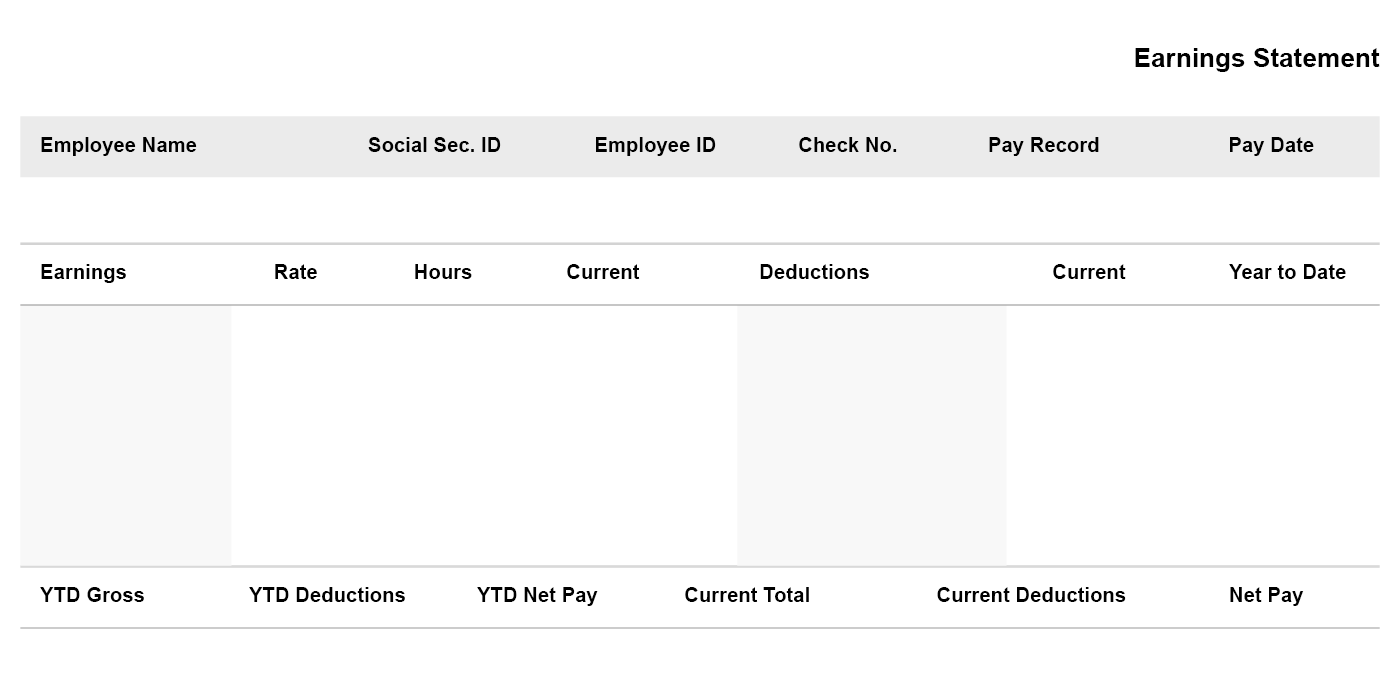

The employer that breaks down an employee’s pay for a specific pay period. Pay stubs to their employees, many institutions still request pay stubs as While most states do not require employers to provide Year-to-date deductions, FICA tax, and income tax withholdings. Or salary, overtime, tips and commissions) as well as all current and It includes all earnings for a specific pay period (hourly wages Create Your Version of This Document What is a Pay Stub?Ī pay stub is an itemized record of an employee’sĬurrent pay.

0 kommentar(er)

0 kommentar(er)